UFI Global Barometer

2024 Record year for the global trade fair industry

The trade fair industry is recovering from the coronavirus pandemic worldwide. The picture shows the Javits Centre in New York. Photo: Javits Centre in New York

The trade fair industry is recovering from the coronavirus pandemic worldwide. The picture shows the Javits Centre in New York. Photo: Javits Centre in New York

The Global Association of the Exhibition Industry (UFI) regularly takes the pulse of the industry: the trade fair industry is currently very lively and continues to be on a healthy course after the pandemic. The findings: In 2024, it will achieve record sales worldwide.

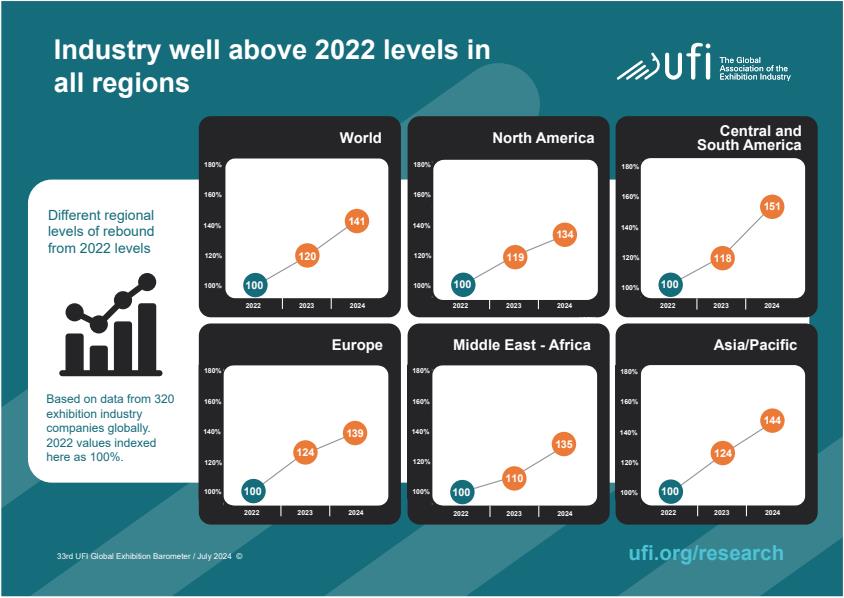

A new edition of the "UFI Global Exhibition Barometer" is published twice a year. The current one shows: The global exhibition industry is buoyant and will achieve record sales this year. The industry is thus continuing its recovery after the pandemic - worldwide. For 2023 and 2024, the Global Association of the Exhibition Industry (UFI) expects sales growth of 20 per cent and 17 per cent respectively compared to the previous year.

In the current survey, 48 per cent of companies worldwide stated that they would react to this development and increase their workforce in the coming months. A further 48 per cent want to keep their current headcount stable. What are the biggest challenges? The answers to this question are mixed. The most pressing issue mentioned was "the economic situation in the domestic market" (22 per cent of responses worldwide), followed by "global economic development" (15 per cent of responses).

For 2023 and 2024, the Global Association of the Exhibition Industry (UFI) expects sales growth of 20 per cent and 17 per cent respectively compared to the previous year. Image: UFI

There is a general consensus that AI will influence the industry: 90 per cent of the UFI members surveyed answered this question in the affirmative. A growing proportion of companies are already actively utilising this new technology. The areas that will be most affected by the development of AI are the same in all regions of the world: sales, marketing and customer relations (83 per cent worldwide), research and development (82 per cent) and event production (69 per cent). "This latest edition of the UFI Barometer confirms our initial data from January that 2024 will be a record year for industry revenue globally. It shows how this growth is translating into new jobs in our sector - as well as the expansion plans of the majority of companies, targeting both new business activities and new regions. Against a complex global backdrop, the short and medium-term outlook for the global exhibition industry is optimistic," says Kai Hattendorf, Managing Director and CEO of UFI. A large majority of companies worldwide want to expand their business activities and develop new ones - in the traditional area of the exhibition industry, but - and this is the interesting thing - also outside the current product portfolio. In the Asia-Pacific region, this figure is 69 per cent, 74 per cent in North America, 75 per cent in Central and South America, 83 per cent in Europe and 84 per cent in the Middle East and Africa. In terms of geographical expansion, 43 per cent of companies intend to become active in new countries and regions.

UFI Global Exhibition Barometer

The UFI Global Barometer is a biannual report on developments in the exhibition industry. In 2009, UFI began assessing the impact of the global economic situation on the trade fair industry twice a year. Since then, this flagship study has regularly increased in scope and coverage as numerous industry associations around the world have joined the project.

The trade fair organisers in Germany

The most important current topics for trade fair organisers in Germany? They are most concerned with global economic developments (21 per cent), geopolitical challenges (19 per cent) and, in third place, the state of the economy in the German domestic market (17 per cent) and sustainability and climate protection (17 per cent). In this respect, the German trade fair industry differs significantly from the global one: There, the topic tends to rank at the bottom with nine per cent. All organising companies expect more turnover and, as a result, better results - and no one is thinking of downsizing their workforce. On the contrary: half of those surveyed are looking for employees and are in recruitment mode. When it comes to "working with AI", it is clear that this is already common practice at the organising companies. Possible effects on exhibitions and the current use of "generative AI" applications such as ChatGPT and others are already being used diligently. In sales, marketing and customer relations, 36 per cent of respondents are working with AI, as are research and development and event production. In human resources, the figure is nine per cent, while almost a third (27 per cent) use artificial intelligence in other fields. Nine per cent work with it in finance and risk management. And, of course, everyone wants to generate growth. The range of activities for this is growing. Many are thinking about becoming active outside their traditional business and developing new activities. There is plenty of space that can be brought to life. In addition, digitalisation is enticing (and demanding). Here too, extending the value chain is an option, for example through digital products and services. For more than half of those surveyed, however, expansion abroad is a strategic priority. It is about opening up new markets for the most important brands and themes. This is where success is most likely to materialise. If you want to delve deeper into the UFI Barometer and take a closer look at how 19 key trade fair markets and regions perform in comparison to both their respective regions and the global average, take a look at the full results..

Christiane Appel