Trade fair business year 2025

On track for global growth markets

This year, German trade fair organisers are planning around 325 trade fairs abroad, which is more than in their own country. Photo: Koelnmesse GmbH, dmg events

More exhibitions this way: This year, German trade fair organisers are planning around 325 trade fairs abroad, more than in their own country. Photo: Koelnmesse GmbH, dmg events

While global trade conflicts and shifting supply chains create uncertainty, companies are adopting a more cautious approach, questioning budgets, and entire industries are grappling with economic challenges, the trade fair industry is also facing pressure. In response, German trade fair organizers are adjusting by focusing their presence on regions with growth and demand: abroad.

As US President Donald Trump begins his second term in office, the impact of his protectionist and nationalist policies on global trade dynamics and geopolitical alliances is becoming increasingly evident. Trump's renewed focus on tariffs, bilateral trade agreements, and stricter immigration policies is sending clear signals to international markets and governments. In February, Canada, Mexico, and China are the first to feel the effects of the escalating trade conflict through severe import tariffs. Global markets are in turmoil, and one term is dominating both the geopolitical landscape and the global economy: uncertainty.

We have been experiencing this uncertainty for several years now. The war in Ukraine, conflicts in the Middle East, the pandemic, and the transformative rise of artificial intelligence are key drivers. Additionally, the unpredictability inherent in Trump’s leadership strategy is causing the World Uncertainty Index (WUI) to soar once again following his inauguration in January 2025. If the US president follows through on his campaign promise to impose a "basic tariff" of 20 percent on all imported goods, history could repeat itself. In 1930, the Smoot-Hawley Tariff Act passed by Congress raised US tariffs to record levels, resulting in a dramatic two-thirds reduction in global trade.

Photo: Deutsche Messe AG, Ole Spata

"Now is the time to move even closer together and develop and resolutely implement a joint geopolitical and economic strategy."

Dr Jochen Köckler, CEO of Deutsche Messe AG

Almost 100 years ago, "retaliatory measures" by trading partners led to a reevaluation of strategic alliances, with trade agreements increasingly being made bilaterally. This type of geopolitical environment is marked by heightened competition, where the global economic order and trade flows can shift rapidly, leading to rising product prices. To survive in this increasingly volatile and unpredictable landscape, companies must continuously adapt their strategies. This is especially true for industries operating internationally and relying on stable trade relations, such as the trade fair industry and many of the sectors it serves. "The economic slowdown in key markets such as China continues to impact industries worldwide. Rising interest rates are having a significant effect, particularly on the construction and property sectors," writes UFI President Hugh Jones in his letter to members of the World Federation of Exhibition Industry in February. "At the same time, the ongoing cost of living crisis has shifted consumer behavior in sectors ranging from retail to gifts. Combined with geopolitical tensions, the overall atmosphere can feel unsettled for many of the industries we serve." The fact that the global exhibition industry has so far adapted well to this volatile environment is reflected in the analysis of the 34th UFI Global Exhibition Barometer for 2025.

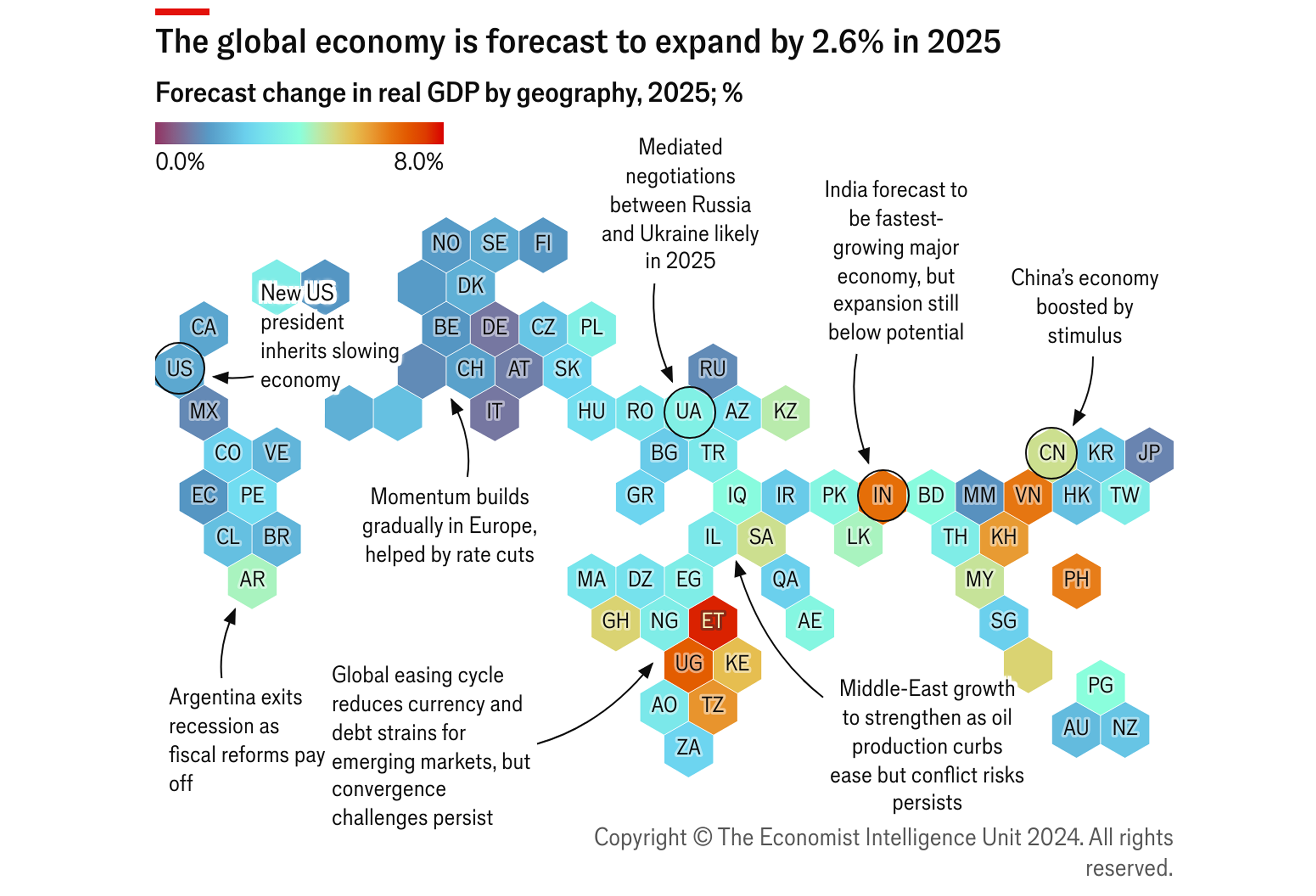

The global economy is expected to grow in 2025 at a similar rate to the previous year. Contrary to the picture, the International Monetary Fund (IMF) is forecasting GDP growth of around 3.3 per cent. In the long term, so-called geopolitical "swing states", i.e. countries that maintain good relations with both the OECD members and the BRICS countries, could benefit. An example of this is India, which is expected to be the fastest growing major economy. Graphic: Economist Intelligence Unit

According to the report, exhibition companies expect to increase their record sales from last year by a further 18 percent worldwide. "This new edition shows positive indicators for the coming year across all markets," says Chris Skeith OBE, UFI Managing Director and CEO. As with the forecasted growth in gross domestic product, there are significant differences at the country level, though these developments are not always aligned. Argentina, the United Kingdom, Italy, Greece, and Colombia are particularly leading the way in expected turnover growth. However, regarding the most pressing medium-term business concern—"global economic developments," followed by "geopolitical challenges"—the industry has long recognized that the world will continue to change.

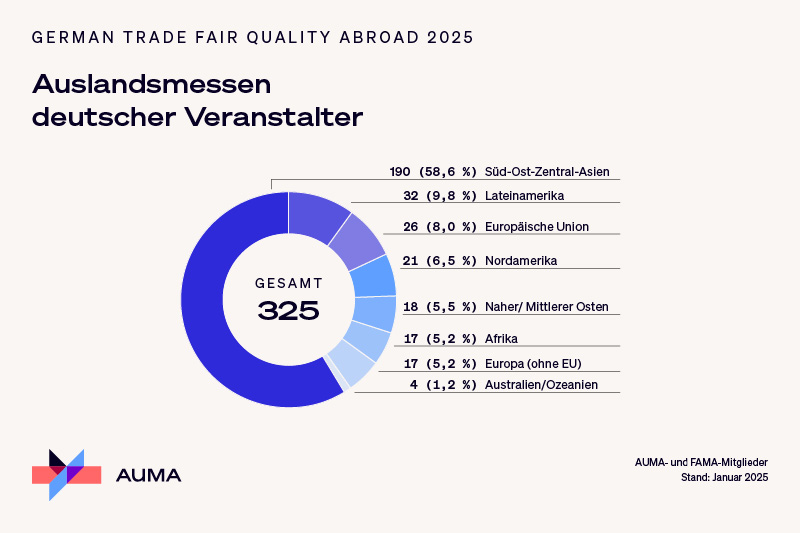

Dealing with these challenges requires trade fair organizers to conduct precise market analyses, engage in strategic portfolio management, and remain willing to adapt business models to changing market conditions. There are always opportunities to do so, even—or especially—in a multipolar world where power dynamics are shifting, and international trade regulations, including visa policies and sustainability guidelines, are being reorganized. International expansion seems to be a strategic priority for German trade fair companies. According to a recent survey by the Association of the German Trade Fair Industry (AUMA), they are planning a total of 325 trade fairs in nearly 40 countries this year—significantly more than in the previous two years, and even more than within Germany itself.

Between record figures and structural problems

Although most of the largest German trade fair companies were able to achieve record sales in 2024, one of the reasons for the increase in foreign business is likely that Germany "has recently lost its international competitiveness," says AUMA Managing Director Jörn Holtmeier. "High energy prices, rising non-wage labor costs, and internationally uncompetitive taxes are making Germany less attractive as a business location. The trade fair industry is feeling the growing caution of domestic companies." After two consecutive years of recession, the mood among many (exhibiting) companies remains gloomy. Michael Hüther, Director of the German Economic Institute (IW), criticizes: "The German economy will not get out of its own way in 2025 either."

The most important foreign market for German trade fair organisers is South, East and Central Asia with 190 events. The foreign trade fairs cover almost the entire spectrum of industries - from automation, construction technology, energy, food and vehicles to agriculture and forestry, mechanical engineering and textiles. There are more than a dozen new projects among the 325 trade fairs in total. Graphic: Association of the German Trade Fair Industry (AUMA)

"The multitude of problems that companies are facing is particularly worrying," continues Hüther. And these are now likely to be joined by the new US administration: for the European country for which the largest Trump Risk Index was calculated due to its close trade, security and cultural ties with the US, the IW analysed the impact on its companies at the beginning of the year. The result: in the event of a confrontational US economic policy, they primarily expect further competitive disadvantages as well as trade and sales restrictions. In its Annual Economic Report 2025, the BMWK expects minimal economic growth of 0.3 per cent, which will also be held back by weak investments. Although most of the largest German trade fair companies were able to achieve record sales in 2024, one of the reasons for the increase in foreign business is likely that Germany "has recently lost its international competitiveness," says AUMA Managing Director Jörn Holtmeier. "High energy prices, rising non-wage labor costs, and internationally uncompetitive taxes are making Germany less attractive as a business location. The trade fair industry is feeling the growing caution of domestic companies." After two consecutive years of recession, the mood among many (exhibiting) companies remains gloomy. Michael Hüther, Director of the German Economic Institute (IW), criticizes: "The German economy will not get out of its own way in 2025 either.""rage (+18 and +9 per cent respectively). The 2025 trade fair calendar lists around 310 trade fairs in Germany, including just under 20 new events. For example, Messe Erfurt is using the "International Year of Quantum Science and Quantum Technologies" for the premiere of its congress trade fair Quantum Photonics (13 to 14 May). May) or Messe Düsseldorf's growth in the global key sectors of technology and energy at its first ediTrade fairs are always a reflection of the markets in which exhibitors operate - and these markets are currently under immense pressure," emphasises Gerald Böse, CEO of Koelnmesse. Trade fair organisers across Germany estimate that sales will be eight per cent higher this year compared to 2024, but their rented exhibition space has fallen by a full twelve per cent since 2019. With these figures, the "number one trade fair location" is well below both the overall European average (+16 and +2 per cent respectively) and the global avetions of Xponential Europe (18 to 20 February) and Gridexpo - International Trade Fair for Smart Grids (28 to 30 October). The North Rhine-Westphalian trade fair organiser plans to launch a total of 17 new formats this year, six of which will take place in Düsseldorf. An important success factor for the company is the growing number of foreign trade fairs: "Our events around the globe secure the position of Düsseldorf's leading international trade fairs in the international competition," says its Managing Director Marius J. Berlemann. The trade fair city of Frankfurt takes a similar view. For their trade fair company, the event business outside Germany contributes more than 40 per cent of group sales. This year alone, over 100 foreign trade fairs are to be organised by its 28 subsidiaries. Like the new trade fair for intelligent building technology FESI - Fiera dell'Edificio Sostenibile e Integrato (14 to 16 October) in Bologna, which brings together various topics ranging from building automation, IoT integration, energy management solutions, building security, electrical and lighting systems to smart and vertical mobility. "With FESI, we are responding to the new requirements of the Italian market, which are evolving rapidly due to the latest European directives," says Donald Wich. The Managing Director of Messe Frankfurt Italia explains: "Legislation prescribes stricter energy and environmental standards for buildings, with the aim of reducing CO2 emissions and improving energy efficiency by 2030." Although Italy's economic growth is forecast to be only slightly higher than that of Germany, there are investments and developments in the energy market there that organisers in this country are keeping an eye on. For example, Hannover Fairs International GmbH, a subsidiary of Deutsche Messe AG, is launching the Hydrogen Power Expo (HYPE, 5 to 7 March) in Rimini for the first time as part of the energy trade fair Key. The background to this is the promotion of so-called "Hydrogen Valleys" throughout the country, for which funding of 500 million euros has been earmarked in the national economic stimulus programme.

„With the election and structural economic challenges, we can see why German companies are generally less optimistic compared to their UK counterparts.“

Photo: RX Global

According to the UFI Barometer, Italian companies are the European leaders in the trade fair industry in terms of the growth of their rented space, which has increased by 15 percent since 2019. Only their colleagues in the UK expect even higher sales growth. In both countries, there is absolute confidence that operating profits this year will be at least ten percent higher than the previous year. From a global perspective, forecasts indicate that Europe has not been one of the major growth drivers for some time. The trade fair industry is reflecting this in the development of the overall capacity of its exhibition centers. After all, growing exhibition space means infrastructure investments and emerging markets.

APAC region overtakes Europe

The Asia-Pacific region is sending a clear signal for the trade fair market: for the first time since the start of the UFI surveys, it will overtake Europe in 2024. China leads the way with a share of over 30 per cent of total global capacity. In Messe München's international segment, the country is "the most important foreign market and gateway to Asia", explains its Exhibition Director Stefan Rummel. Together with Deutsche Messe, Messe Düsseldorf and a local operator, the Munich trade fair company has been running the SNIEC - Shanghai New International Expo Centre, one of the most successful exhibition centres in the People's Republic, since 1999. This year, the satellite events of Munich's world-leading trade fairs productronica and electronica will once again be held here. Interest in electronics trade fairs may benefit from the fact that China's ruler, Xi Jinping, is aiming to boost the economy by strengthening the cutting-edge technology sector. Although growth has been below average since the pandemic, it remains stable enough to consolidate China’s role as the engine of the global economy. However, an escalating trade dispute with several trading partners could pose a threat to its economic growth. To improve the situation and overcome the prolonged property crisis and over-indebtedness, Beijing has announced its intention to pursue more proactive and flexible economic policies in 2025, along with promised economic stimulus.

Messe München owns the Shanghai New International Expo Centre (SNIEC) via GEC GmbH (German Exposition Corporation International) together with Deutsche Messe Hannover AG, Messe Düsseldorf GmbH and the Chinese company Shanghai Lujizui Exhibition Development Co. Ltd. Completed in 2011, the SNIEC claims to have the highest turnover rate of any exhibition centre in the world. Photo: GEC GmbH

The former newly industrialised country has already achieved an unprecedented upswing in recent decades, which has drawn the trade fair industry along with it. Messe Düsseldorf (Shanghai) Co., Ltd. has identified the growing market for organic consumer goods due to the rising standard of living and plans to establish the Organic Festa Asia (3 to 5 September) at SNIEC from this year. Messe Frankfurt has once again identified the security industry as a global growth market and is bringing the first Intersec Shanghai (13 to 15 May) to the National Exhibition and Convention Center. Since its first trade fair for the textile industry in 1987, Messe Frankfurt (HK) Ltd. has expanded its portfolio to over 45 trade fairs in the Greater China region and intends to further strengthen its presence in the Central Asian market. In the other direction, countries in the APAC region such as India, Vietnam, Indonesia, and South Korea are also benefiting from extensive infrastructure projects, a young and growing population, and increased integration into global supply chains and regional trade agreements. Koelnmesse is seizing the opportunity created by the targeted economic policies, including measures to restrict the export of raw materials and the growing construction industry, to venture into Jakarta this year. It will expand its event portfolio with the newly developed events Interzum Jakarta, alongside the International Hardware Fair (IHF) Indonesia—powered by Eisenwarenmesse (24 to 27 September)

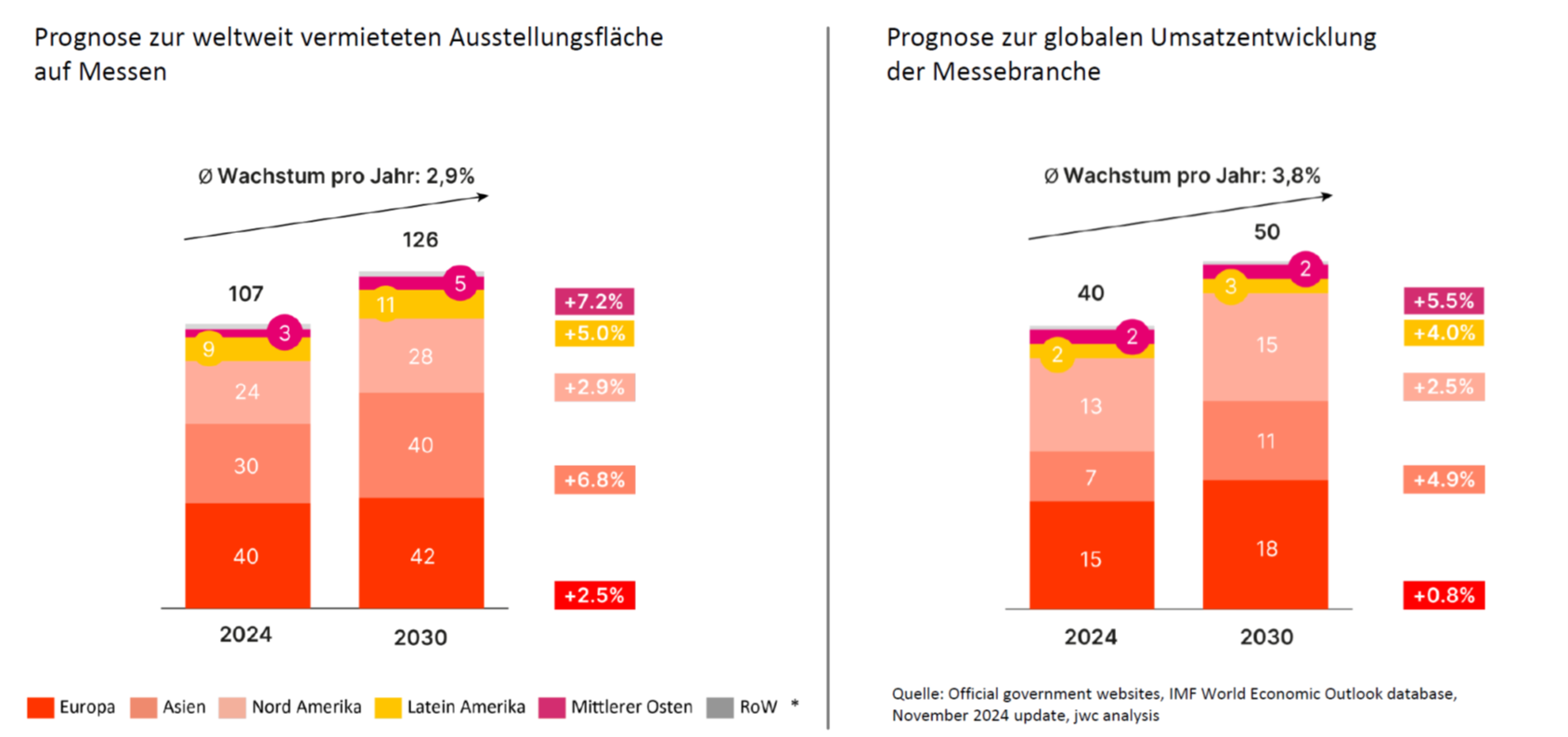

The drivers of the trade fair industry: Forecasts of exhibition space rented at trade fairs worldwide and global sales development in the trade fair industry by region. Graphic: Messe Düsseldorf

"Southeast Asia is the fastest growing economic region in the world," emphasises its trade fair director: "Within this region, Indonesia is the largest market and an important centre for global furniture production." By merging the trade fairs for furniture production and interior design as well as for hardware, the entire furniture production value chain will be represented at one time and in one place in future. "This will enable us to support our customers in the Southeast Asian market and create synergies between our events in Cologne and abroad," Böse continues. In addition to the two Indonesian premieres, Koelnmesse is planning seven other new international launches for 2025.

"If you want to be ahead in the global trade fair market ..."

This year, the Cologne-based company is also expanding its international offering in the Middle East under the IHF brand. With the offshoot International Hardware Fair Saudi Arabia in Riyadh, the hardware industry is to be given a new platform for its international and local sector companies. With the current boom in the Saudi construction industry, the latter are experiencing a surge in demand for building materials, DIY products, hardware and tools. From 16 to 18 June, the FSB Sports Show Riyadh will celebrate its premiere in the Saudi Arabian capital at the same time. "This new event is also in line with Saudi Arabia's Vision 2030 and promotes the Kingdom's ambitions to become a top global sports destination," says Matt Denton, President of trade fair organiser dmg events, which is working with Koelnmesse to organise the two trade fairs.

Saudi Vision 2030

The Saudi Vision 2030 is a government programme initiated by Crown Prince Mohammed bin Salman Al Saud with the aim of reducing Saudi Arabia's high dependence on the crude oil sector. The programme focuses on the long-term diversification of the economy with measures to promote the private sector and tourism, the construction of futuristic cities and the development of new mineral resources. However, due to limited state resources and declining private direct investment, significant cuts had to be made to key projects in 2024. Donald Trump's return to office is viewed ambivalently in Saudi Arabia: Although there are close economic ties with the new US administration, Trump's Middle East policy, his confrontational attitude towards China and his endeavours to increase US oil production could impair the Vision 2030 transformation process, according to the Stiftung Wissenschaft und Politik.

As part of Vision 2030, the German trade fair industry sees a lot of new potential and points of contact for the various industry events. The Ministry of Industry and Mineral Resources in Saudi Arabia, for example, is driving forward the development and diversification of the industrial and mineral sector in the Kingdom as part of the transformation process. Deutsche Messe AG intends to capitalise on this for the debut of its Industrial Transformation Saudi Arabia (ITSA) (1-3 December), which will showcase the latest developments in smart manufacturing, Industry 4.0 and advanced industrial technologies such as robotics in Riyadh. As economic output in the entire Gulf Cooperation Council has almost doubled between 2010 and 2024, the region is also high on Messe Düsseldorf's agenda. Its Executive Director Petra Cullmann is certain: "If you want to be at the forefront of the global trade fair market, you have to be active in the Gulf region." For this reason, the Düsseldorf organisers commissioned an implementation company at the beginning of the year to further develop their business from Dubai. The "Messe Düsseldorf Gulf Office" is to organise regional versions of Euroshop, A+A and Rehacare in Dubai for the first time from 2026. The business centre "acts as a hub between Europe, Asia and Africa and offers us the perfect platform to expand our international business," explains CEO Wolfram N. Diener. This is because a consistent internationalisation strategy also means that, conversely, more international exhibitors and visitors will come to the Düsseldorf trade fairs. The international trade fair business creates synergies and thus virtually strengthens the competitiveness of the German location. "Competitiveness also depends on a clear economic policy strategy," emphasises Dr Jochen Köckler, CEO of Deutsche Messe AG. "In recent months, there has often been talk of geopolitical uncertainties. But my observation today is different: The Munich Security Conference has recently provided relentless geopolitical clarity." After all, the USA signalled unequivocally there that it will consistently continue its "America First" policy. "At the same time, China is demonstrating that the state is providing massive support for its industry and steering its economic course in a targeted manner." According to Köckler, this is a clear signal for Europe and its partners in the global community: "Now is the time to move even closer together and develop a common geopolitical and economic strategy and implement it with determination." In this country, this applies in particular to the new German government, which is called upon to quickly compensate for locational disadvantages and set the framework for international competitiveness. This makes it all the more likely that the German trade fair business abroad will remain more of an expansion than an "emigration" in the long term.

New for our international readers:

For the first time, we are offering an English version of our magazine in addition to the German edition. The translation was made with the help of AI and is currently in the test phase. We’d love to hear your feedback on this new service!